In this day and age, technology plays a bigger role than ever before. It has been incorporated into all aspects of our daily lives, making our personal and professional lives a lot more convenient. Not only does this apply to tech-related industries, but the advantages have also crossed over to most (if not all) professional fields.

In recent years, the real estate market has evolved from the stereotypical analog transactions, where you’d actually have to go to a real estate agency, into much more efficient, tech-aided interaction for both the owners/agents and the buyers/renters.

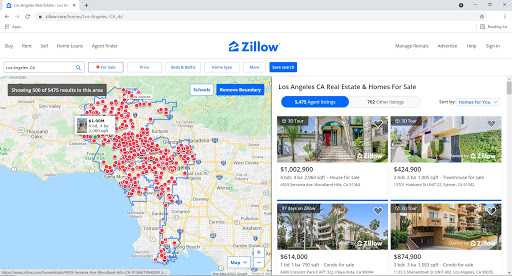

Long gone are the days when people would drive around neighborhoods to look for new houses and have to collect the contact information from signs put up in the yards, or have to visit several agencies to find a suitable property. Technology has helped us find all that information in an instant (through sites like realtor.com, trulia.com, zillow.com) while allowing us to visualize what the place is like before even visiting it.

A survey found out that 52% of buyers found the home they purchased on the internet. Source: 2020 National Association of REALTORS® Profile of Home Buyers and Sellers

Technology has also made the business side of real estate a lot easier since all the data is now on the internet. Realtors can find listings in a specific area online, rather than having to accumulate them manually. Aggregator sites and applications provide the convenience of compiling property listings with detailed information from all across the web.

The information given by real estate sites and apps usually include:

- Size

- Property type

- Location

- Sale price

- Amenities

- Monthly rental price

- Parking spaces

- Agent Contact

Another aspect of real estate that has been affected is the technical data that aids in property appraisal. This is an important factor in the real estate business since it enables you to foresee and gain insights into the market and future valuation of properties.

Actual Property Value

In order to make better decisions, you have to know the actual value of a property, and its chances of increasing/decreasing.

This is determined by 4 major elements of value:

- Demand - the desire or need for ownership of a certain property supported by the financial means to satisfy that desire.

- Utility - the specifications, functionality, and amenities given by a property to match the future owners’ preferences.

- Scarcity - the number of competing properties with the same or close specs within a certain area.

- Transferability - the ease with which ownership rights are transferred.

Keep in mind that cost does not necessarily equate to value since the factors above are also key determinants in the actual value of a property.

Other factors that determine price are:

- Age and condition of the property

- Terms and conditions of sale

- Location

- Physical features

- Rate of return (for income-producing properties)

Vacancy Rates

The vacancy rate is the percentage of all available or unoccupied units in a rental property at a certain time. Having access to vacancy rates of properties can tell a lot. It can project the desirability and income potential of a property. Vacancy rates can provide guidance on how competitive a property is compared to similar properties in close proximity. This information can also be an indicator as to why the vacancy is at that rate.

Investment Analysis

The aim of investment analysis is to determine how an investment is likely to perform, possibilities and methods of raising the value of the property, and how suitable it is for a particular investor.

The main aspects which influence investment decisions are as follows:

- Purchase price of real estate,

- Increase in the market value of the real estate

- Maintenance costs,

- Real gross income

- The interest rate applied to a credit

- Credit repayment period,

- The ratio between credit and investment value

- Tax allowance

- Tax rate

- Forecasted time of owning an estate

- Desired return on investment

Another crucial element that determines the attractiveness of real estate investment and influences investment value is the location. The location covers not only the physical estate but also includes the economic location. Economic location pertains to the accessibility of a property to social and technical infrastructure, as well as the opportunity to capitalize on the benefits provided by nearby business entities.

Rental Yield

Rental yield is basically the amount of money you make on an investment property by measuring the gap between your overall costs and the income you receive from renting out your property.

Understanding how property yield works give you a better idea of the prospective return you will earn on your investment. It can come in when it comes time to calculate the rent on an investment property.

For long-term real estate investors, understanding the rental yield of potential property investment is crucial in deciding if the property is worth investing in.

Competition Monitoring

Knowledge of how peers in the industry are operating, marketing their brands, and pricing their properties can tell a lot more than one might think. It can give us an idea of market trends and direction, marketing techniques, and how to go about appraising properties. In addition to that, it could uncover areas that are not given much importance, which the investor could capitalize on to develop better services.

The data needed by realtors, buyers, renters, and real estate investors are usually a lot and is scattered in different online sources. It is too mundane of a task to have to look around different websites and numerous listings to find the information you need. This is where web scraping comes in.

With the help of web scraping services, all of the information you need is automatically collected, organized, and presented to you in table forms. This saves you a lot of time and effort when it comes to curating data, especially if this needs to be done frequently.

Learn more about how web scraping works

The right web scraping tool operates within user-set parameters (note that some parameters are mandatory) which let you select what data to gather from the websites you want to scrape. Web scraping takes over the tedious task of curating and arranging your data, allowing you to focus on directly understanding the given information and giving you the headspace to figure out your business operations.

ScrapeOwl enables you to do this and more! With our powerful, easy-to-use interface, you can gain access to all the information you need. Not only that, we will also help you figure out a plan with actionable steps to accomplish your goals.

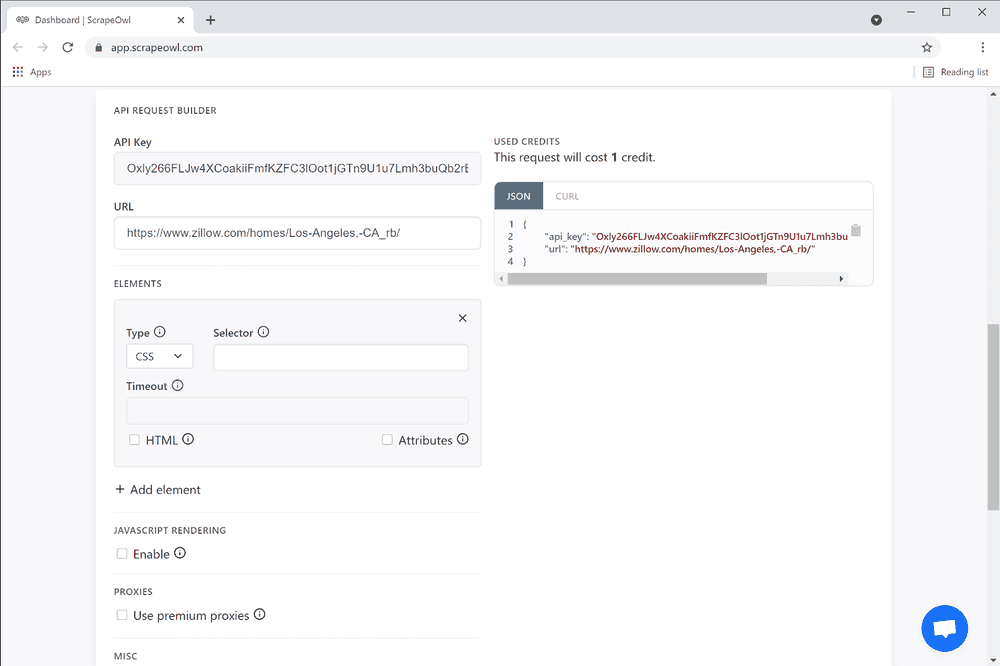

There are 2 ways to use ScrapeOwl in order to gather the information you need from real estate websites: Using the ScrapeOwl API

The first step before you can start using the ScrapeOwl API is signing up and creating an account by going to the registration page or logging into the dashboard if you already have an account.

Once you access the dashboard, all you have to do is place the link of the site you want to scrape in the API Request Builder URL field. For more advanced settings, make sure to check out ScrapeOwl’s API docs.

In this example, we’ll be scraping Zillow, to take a look at homes for sale in Los Angeles, CA.

As you can see below, we entered the link into the URL field to generate the basic code. The code will be adjusted depending on the data we wish to collect from the site.

The beauty of ScrapeOwl lies in its power to extract specific data, specified by the parameters in the code. For a complete list of parameters and commands, visit ScrapeOwl’s API docs.

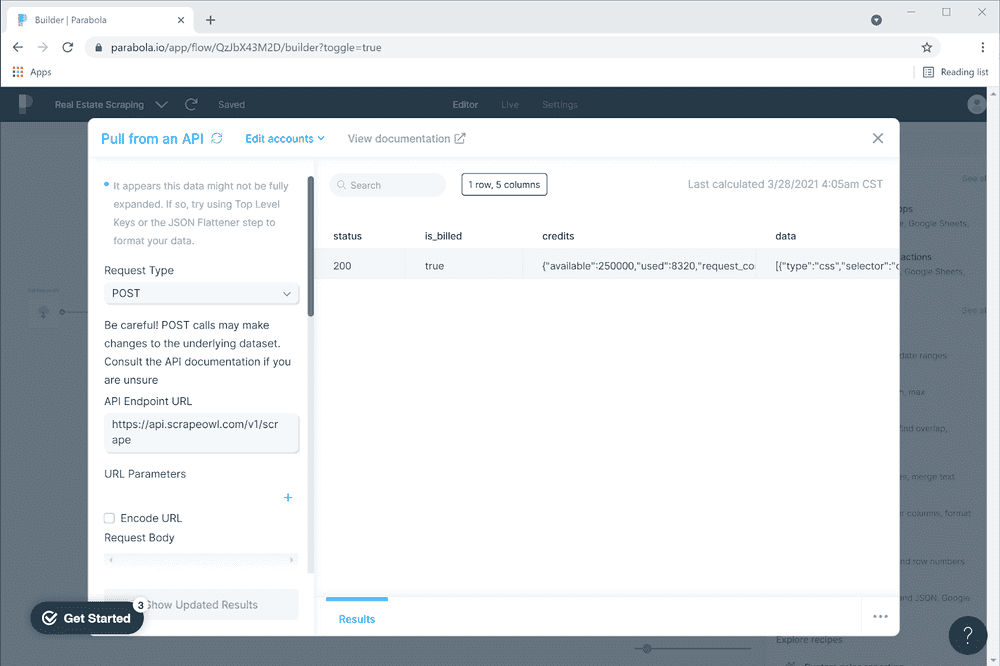

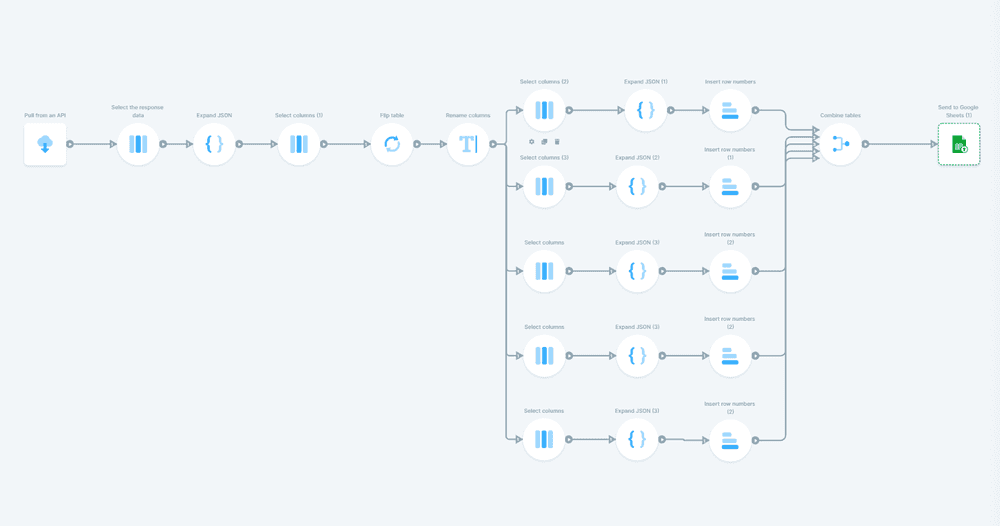

Putting this into action, we’re gonna use Parabola to extract and organize our data into a table.

After signing up to Parabola, start by creating a new flow.

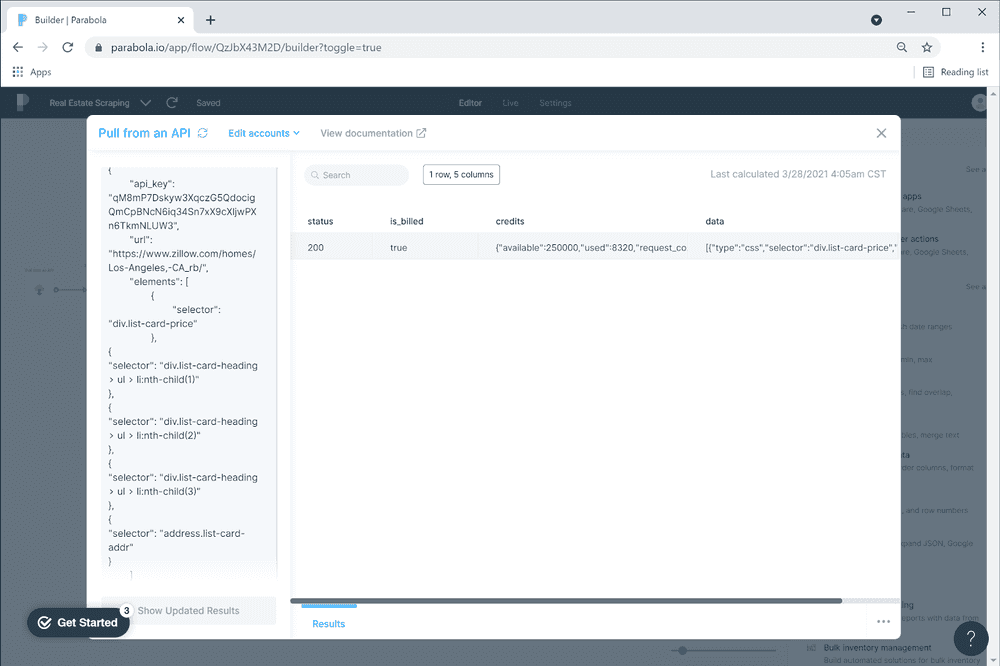

In order to extract the data using Parabola, you have to copy the code generated by ScrapeOwl’s API Request Builder (which can be found in the dashboard), editing the code as needed depending on what elements you’re extracting. In this example, we’re extracting the four most important details to consider in real estate:

- Price

- Number of bedrooms

- Number of bathrooms

- Area

- Exact Address

We edited the code a little bit to extract the data listed above.

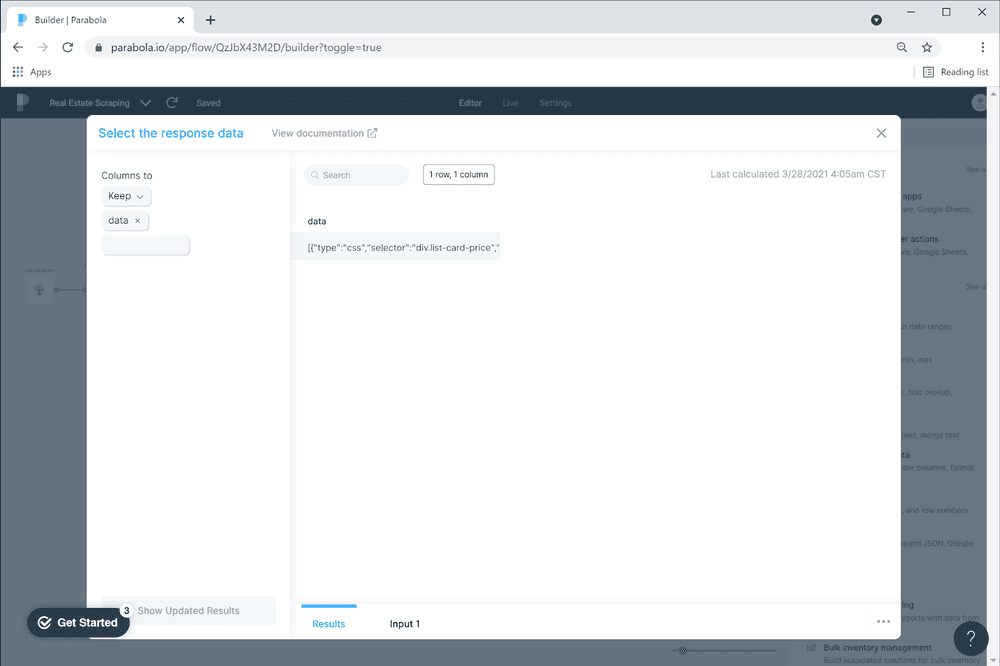

After pulling the data using the ScrapeOwl API, let’s start organizing it

We start off by selecting the response data to keep. In this case, we are keeping all of our data, since we only extracted the data we need using our code.

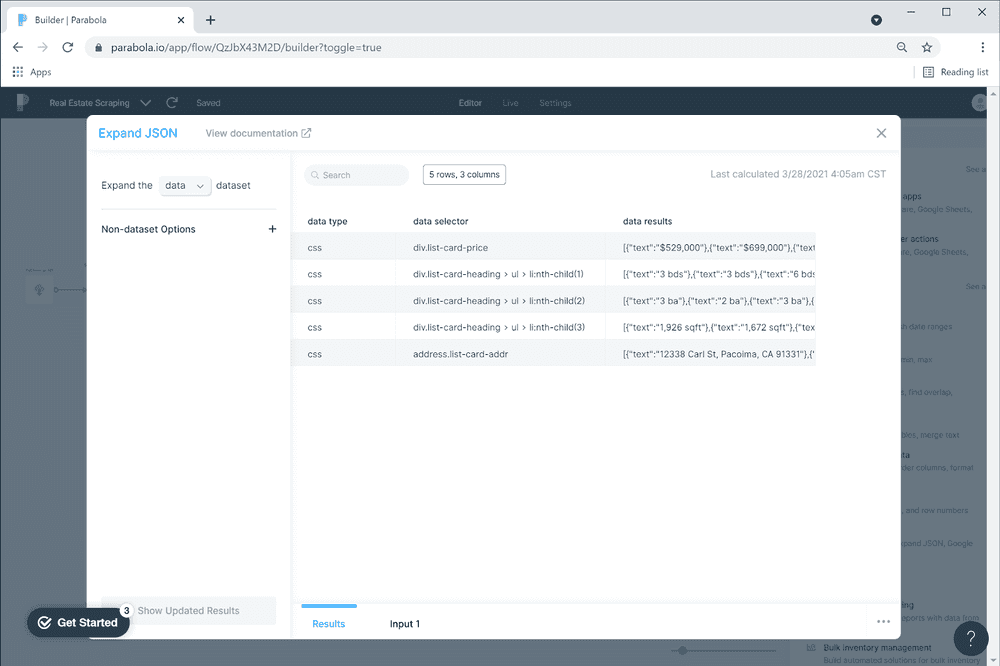

Now that we have our raw data, the next step is expanding it. This results in a table with a certain number of rows and columns, depending on your pulled data.

As you can see in the snippet above, the data is arranged into 5 rows and 3 columns. We need to further expand this data and arrange it accordingly.

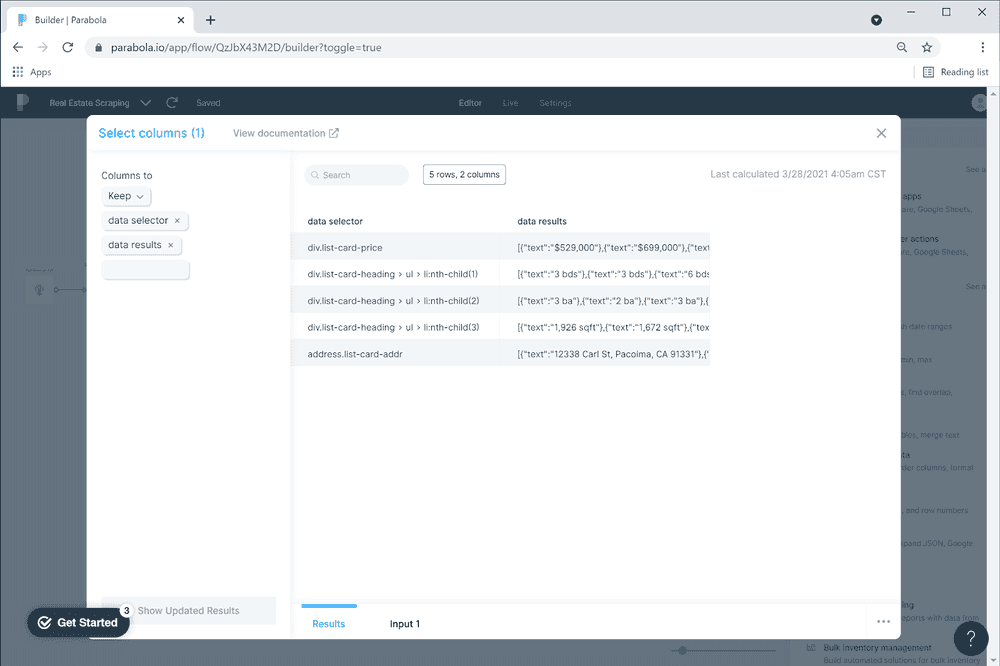

We’ll get rid of the unnecessary data by removing the data type column.

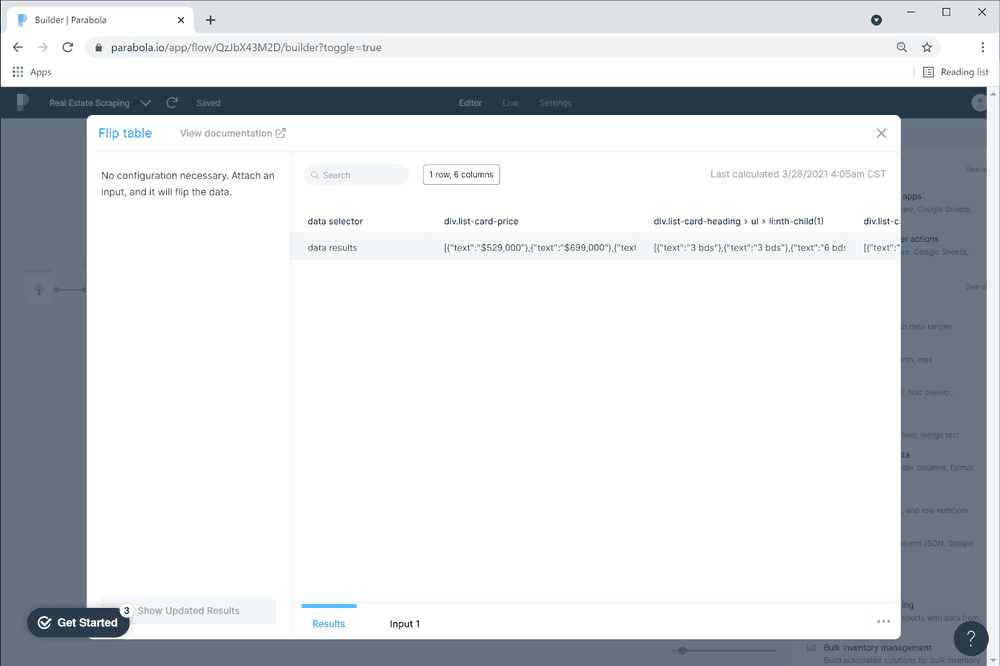

By removing the data type column and flipping our table, our data is now a bit more comprehensible.

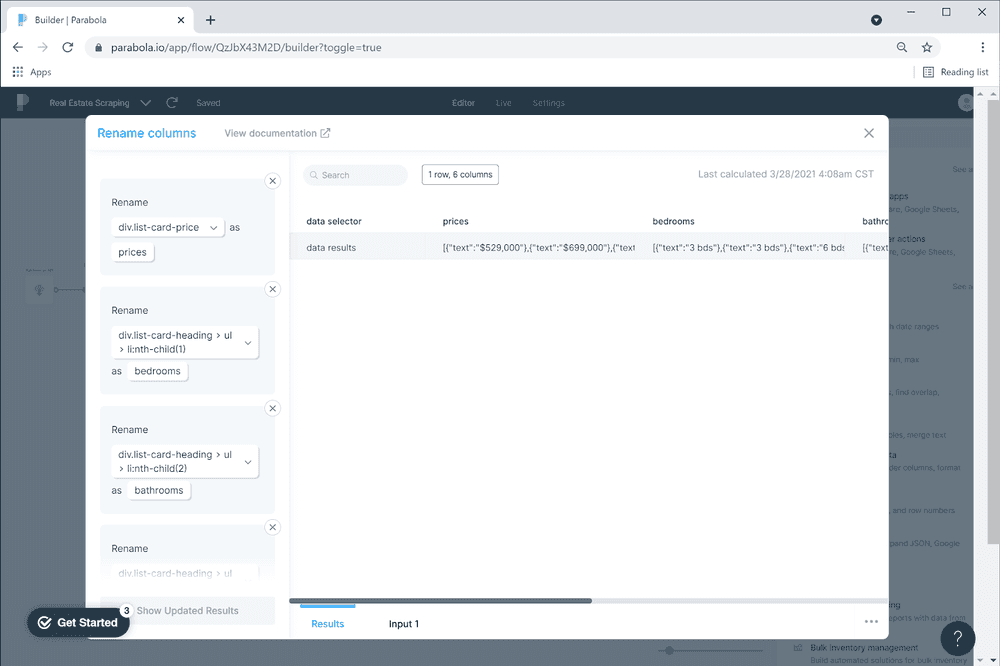

Then rename your columns for accurate interpretation of the data.

Here is the tricky part:

-

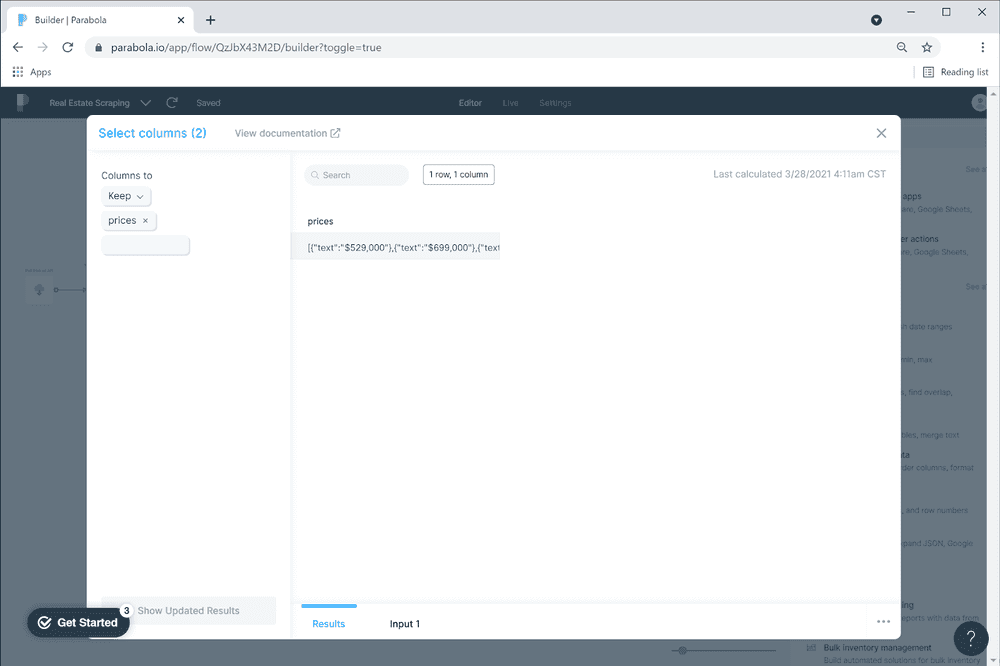

We’re gonna take one category at a time and organize it in a separate table. We’ll start with the prices.

-

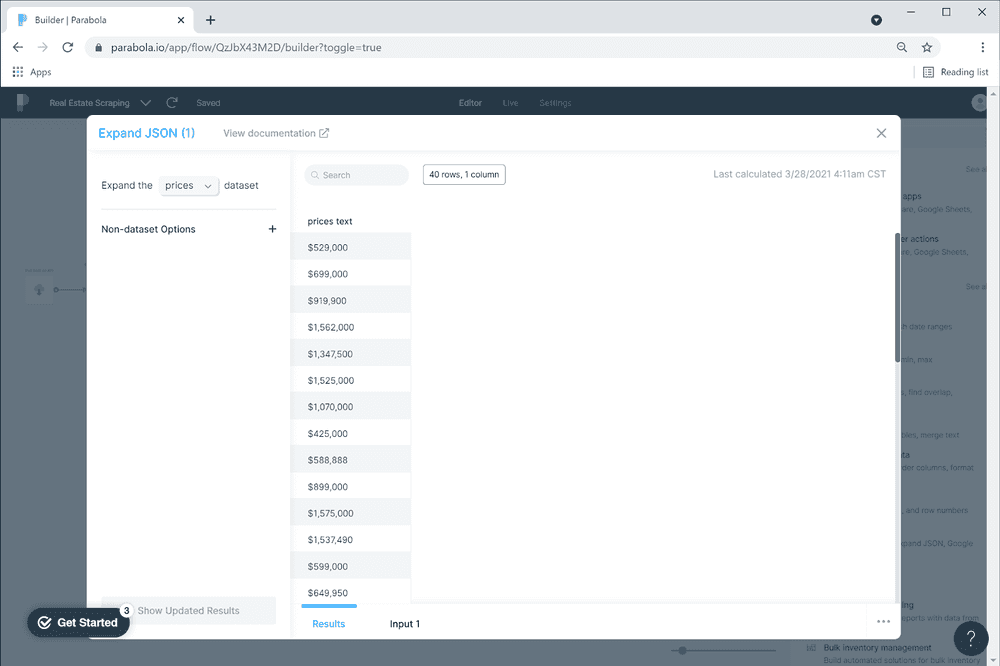

After selecting the dataset, we’ll expand it in order for each entry to be placed in a separate row.

-

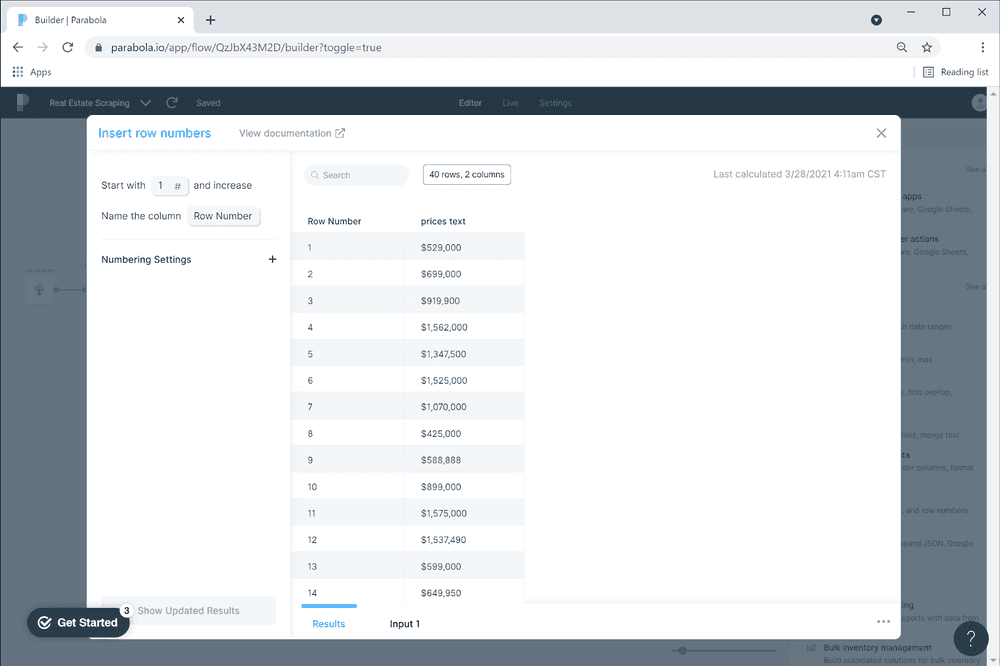

We’ll now insert row numbers into our separate datasets for us to be able to put all the data back together in one table, respectively.

Repeat steps 1-3 as many times as needed to cover all your datasets. In the case of this example, we’ll be doing it 5 times, once for each of our categories

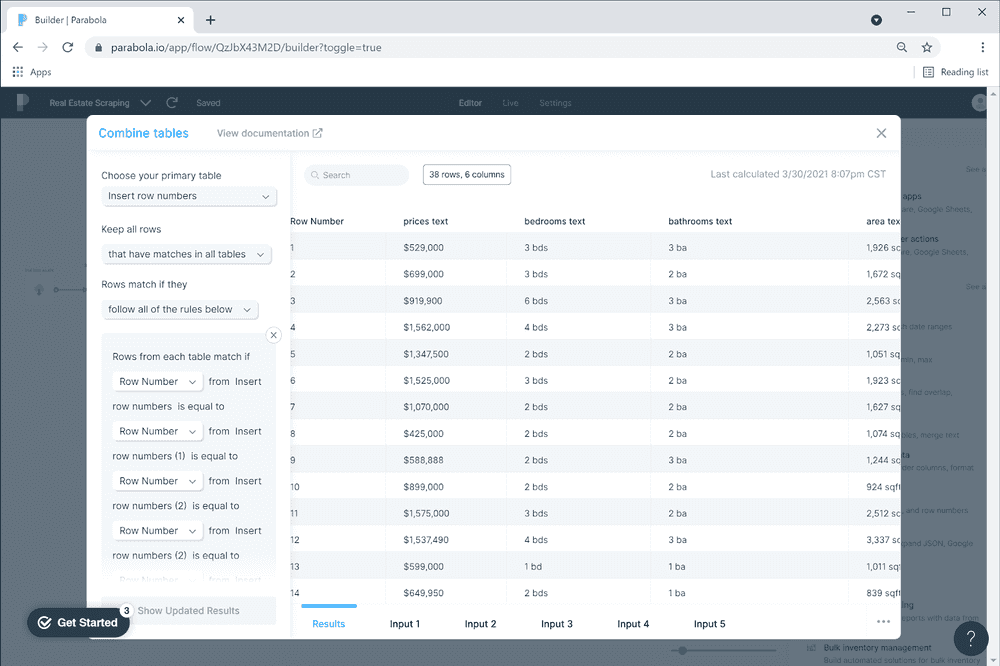

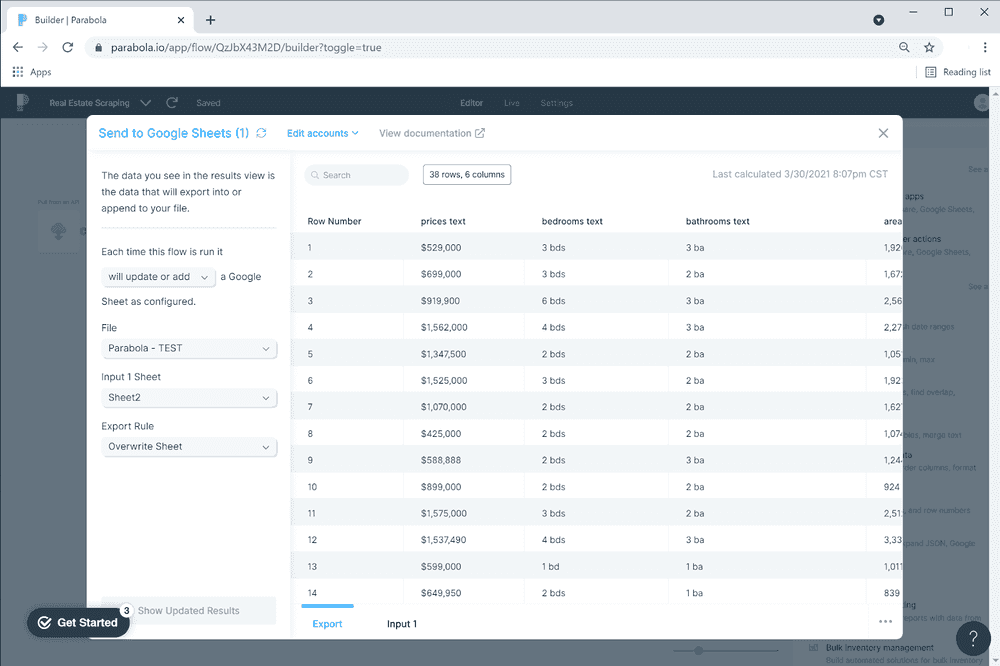

Once we’re done with all the categories, we’ll bring them back together into one table.

And we’re almost done! This is what the final table looks like.

Your Parabola flow should look something like this.

For more information on using Parabola, visit Parabola’s help guide.